Opportunity Zones

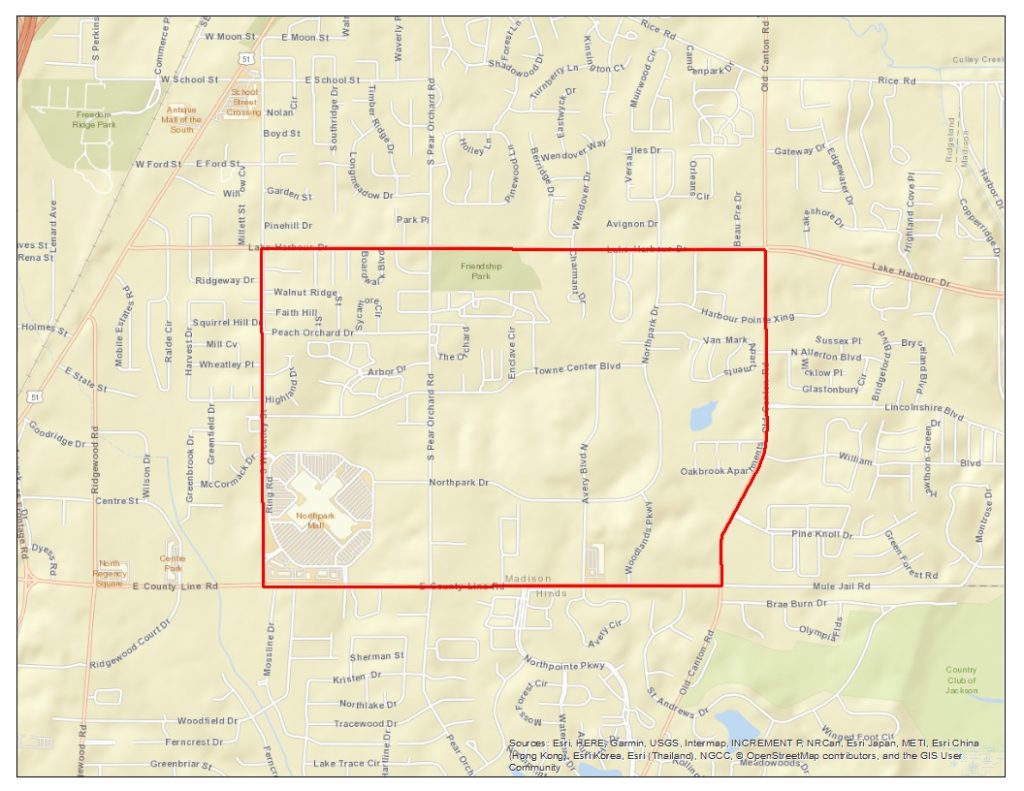

The U.S. Department of Treasury and the Internal Revenue Service designated 100 Mississippi Communities as Qualified Opportunity Zones in 2018. Ridgeland was selected to have a Qualified Opportunity Zone.

Qualified Opportunity Zone Incentives:

- The investments in the Opportunity Funds are intended to specifically encourage investments that will be used to start businesses, develop abandoned properties or provide low-income housing in low-income, economically distressed communities. The investments are intended for new businesses or to substantially improve the existing business property within 30 months.

- It allows potential investors to temporarily defer the recognition of gain invested in a qualified opportunity fund (“Opportunity Fund”) within 180 days from the sale or exchange creating the gain; a possible step-up in the basis of their investment, and possible permanent exclusion of the appreciation on such investments if the holding period is at least 10 years.

- The Opportunity Funds will use the proceeds from such investment to acquire either (a) stock or partnership interests in a business that uses its business property in Qualified Opportunity Zones or (b) business property in Qualified Opportunity Zones.

If you would like information on the Ridgeland Opportunity Zone, please contact Alan Hart or Bryan Johnson at 601.856.3877. For more information about Qualified Opportunity Zones please visit, U.S. Department of the Treasury Community Development Financial Institutions Fund and The Internal Revenue Service Frequently Asked Questions Page on Opportunity Zones.